|

|

|

|

- Eschels Financial Group continues to be the portal for agents and advisors to expand their businesses, beginning with coaching and idea development. As this month is concluding, we cordially invite you to attend a few of our last webinars of the Fall 4th quarter season. One America– an alternative to Long Term Care, (Dec 4th, Dec 14th and Dec 17th), and Fidelity and Guaranty (F&G) Fixed Indexed Annuities part 3 (Dec 3rd). This week begins the time of year when we take a breath, reflect on the past year and enjoy time with friends and family. Eschels Financial Group will be closed Thursday, November 26th and Friday, November 27th in observance of the Thanksgiving Holiday. We will resume business on Monday, November 30th at 8:30 am EST. We wish you all a wonderful relaxing holiday.

- One America has the Long Term Care solutions for your clients with lump sums of money. The sessions are 45 minutes in length. Please note you are with Eschels Financial when registering.

Topics covered:

1) Covering two individuals under one policy

2) Lifetime benefits and the advantages

3) Use of IRA, 401k, 403b to pay for LTC

4) Guaranteed Premiums

5) Covert NQ annuities to tax-free for LTC!

6) Options from age 20 – 85

7) Annual and single pay

- Fidelity and Guaranty Annuities (F&G): This is a strong carrier for retirement solutions and recently has rolled out a new Fixed Indexed Annuity on the line up. These 2 sessions are all different and will build upon each other, if your schedule allows, consider attending both.

Please register for Fidelity & Guaranty Life Annuities – Eschels

Financial Group on Dec 3, 2015 10:00 AM EST at:

Register now!

https://attendee.gotowebinar.com/register/7155730894609430274

Learn more about the Fidelity & Guaranty Life annuity portfolio.

After registering, you will receive a confirmation email containing information about joining the webinar.

Eschels Financial

Group

TAX DIVERSIFICATION AND THE ADVANTAGES OF LIFE INSURANCE AND ANNUITIES

|

|

Your clients must pay taxes during at least one of three time periods: contribution, accumulation, or distribution. That’s the bad news. The good news is that the IRS effectively allows you to pick which phase their savings will be taxed during via the use of different financial products.

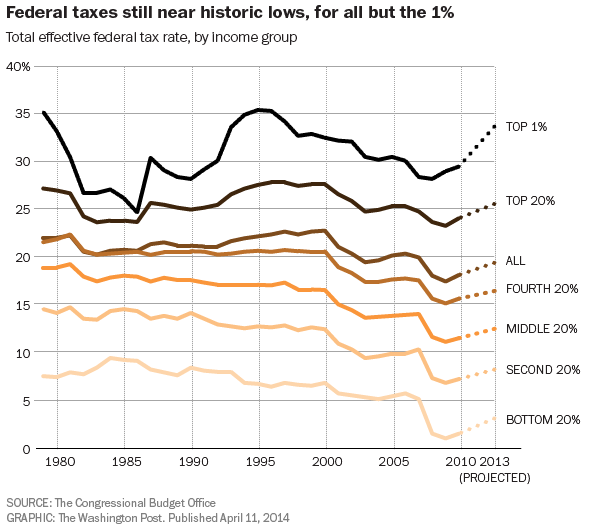

Furthermore, while it may not feel like it, current effective federal tax rates are near historic lows. And with the Congressional Budget Office projecting that the total Federal debt is set to explode over the next 10 years, it’s reasonable to wonder if your clients’ effective tax rates will be higher in the future. Which is when traditional retirement vehicles, such as 401(k)s and IRAs, would be at their highest values and expected to be called upon to begin providing distributions.

Thankfully, life insurance policies that accumulate value are one of the few options that are not taxed during accumulation and have tax-advantaged methods of distribution. So consider suggesting life insurance to your clients as a tax diversification strategy and help protect them against the risk of future tax increases.

Below you’ll find resources to help you describe the tax advantages of annuities and life insurance to your clients. Review and call me to discuss how we can help you implement these strategies into your practice!

.png)

|

|

|

|

|

Insights That Shape the Future Tax Rate Outlook: |

- At current tax rates and expenditure levels, tax revenues are projected to be fully consumed by 2030

- The federal government had $74.3 trillion in debts, liabilities, and unfunded obligations at the close of its 2014 fiscal year

- Budget deficits are projected to nearly double by 2024 as retiring baby boomers strain the health and retirement systems

|

To learn more please contact Eschels Financial today!

Cyndi Stern

Eschels Financial

Email:cyndi@eschelsfinancial.net

Phone: (248) 644-1144 |

|

The stock market can be an uncomfortable place for some clients.

The stock market can be an uncomfortable place for some clients.

Consider these three recent bull markets*:

- 1997-2000: Up 100% before declining 86%

- 2003-2008: Up 90% before declining 53%

- 2009-2014: Up 142%… where do you think the market will go from here? Now could be a great time to exercise a “correction protection” strategy for your clients by investing in the Protective Indexed Annuity II.

If you have clients nearing retirement who are concerned about another decline, ,help them exercise “correction protection” by taking their gains out of the market and investing it in the Protective Indexed Annuity II. This solution provides protected growth, opportunities for higher returns, and even offers secure retirement income with SecurePay SE, an optional withdrawal benefit.

Contact me now for more information:

Cyndi Stern – Marketing Director

Eschels Financial Group

(248) 644-1144, ext. 110

cyndi@eschelsfinancial.net

Is your client’s non-qualified annuity or qualified annuity where it needs to be?

According to Gallup’s 2009 survey of non-qualified annuity owners:

- 81 percent surveyed intend to use their annuity as a financial resource to avoid being a financial burden on children.

- 73 percent surveyed intent to use their annuity as an emergency fund in the case of a catastrophic illness or for nursing home care.

Make sure your clients’ annuities are aligned with their intentions.

The Pension Protection Act (PPA)allows for income tax-free withdrawals from specially designed non-qualified annuities to fund long-term care expenses, regardless of cost basis. By exchanging a current annuity for an annuity that qualifies for the PPA advantages, your clients can be matched with a vehicle that can meet their needs while providing a tax advantage. Of course, before any annuity exchange is made, all factors should be weighed to verify the client’s best interest.

|

|

|

|

|

|

|

|

|

|