|

|

|

|

-

Growth: such a powerful word used in many different contexts. We work towards growing everything; with the exception of our waistlines, GROWTH is the primary focus of almost all important topics. Clients want their money to grow, advisors and agents want their businesses to grow and in January each year, we have a blank slate to get back on the path to growing as clients are faced with “How will my retirement money grow and grow SAFELY in uncertain times?”, advisors and agents are faced with ” How will I bring new ideas, get in front of new prospects with those new ideas and how will I grow my business this year?”. Those of us in the business for any length of time know that there is no magic pill, but we also know that if we empower ourselves with concepts and ideas that we may not have explored before (or not explored for a long time), we will find growth in the excitement of learning. Clients will have new solutions. And the trajectory of business will be upward!

-

Although we all believe that meeting with clients throughout the year is important but now, January through April, is the time that clients have money on their minds more than any other time of the year. Budgeting, credit card debt, building an emergency fund, improving credit scores, saving for retirement, tax planning, life insurance discussions, pre-retirement planning/rollovers and reviewing past investment decisions for alterations are just some of the many topics on client’s minds.

Looking for the latest 2016 tax summary guide? Download here

-

How will you guide your clients and prospects this year with new ideas? As we have known and anticipated for the last several years, interest rates are now on the way back up, and retirement income will be affected if bonds are the primary source. Have you considered the importance of showing a client what a guaranteed income would look like, one that has the opportunities to increase as the index performs?

-

We are truly excited to introduce Jackson National Fixed Indexed Annuities in our office for a Workshop on Tuesday, January 19, 2016 at 12 Noon- 1 pm. Brendan Nelson, Regional Vice President with Jackson National Life Distributors, will share with us how powerful the Fixed Indexed Annuity portfolio is, especially working in tandem with other retirement vehicles. Please call our office at 248-644-1144 to reserve a seat. A light lunch will be served at 11:30am.

Events For February 2016?

Ø American National (ANICO) will present a Life Insurance and Annuity Webinar with us on Tuesday, February 9, 2016 from 10am-11am EST with Jeff Moore, National Sales Manager. The registration link and information is below:

· Please join the meeting from your computer, tablet or Smartphone.

Ø American National (ANICO) will join us in presenting a Life Insurance and Annuity Workshop in our office locally on Wednesday, February 24, 2016 at 12 Noon-1pm with Jeff Moore, NSM. As a continuation of the ideas discussed on the Feb 9th Webinar, Jeff will continue in detail on the ANICO Life Insurance and Annuity case design opportunities for your business growth in 2016. There will be a light lunch served at 11:30am. Please call our office to reserve your seat at 248-644-1144.

Eschels Financial Group

TAX DIVERSIFICATION AND THE ADVANTAGES OF LIFE

INSURANCE AND ANNUITIES

Your clients must pay taxes during at least one of three time periods: contribution, accumulation, or distribution. That’s the bad news. The good news is that the IRS effectively allows you to pick which phase their savings will be taxed during via the use of different financial products.

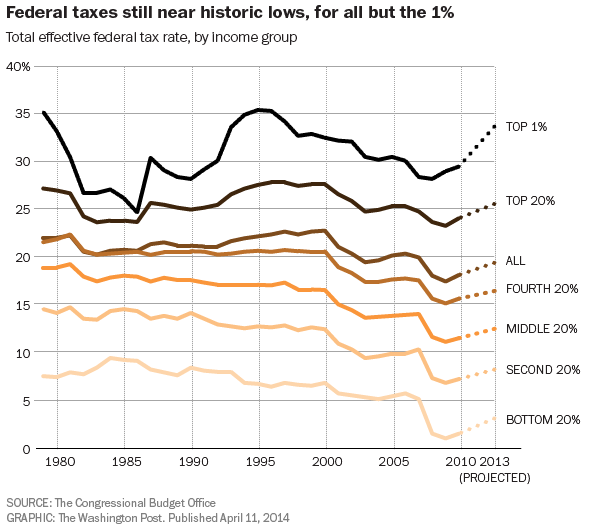

Furthermore, while it may not feel like it, current effective federal tax rates are near historic lows. And with the Congressional Budget Office projecting that the total Federal debt is set to explode over the next 10 years, it’s reasonable to wonder if your clients’ effective tax rates will be higher in the future. Which is when traditional retirement vehicles, such as 401(k)s and IRAs, would be at their highest values and expected to be called upon to begin providing distributions.

Thankfully, life insurance policies that accumulate value are one of the few options that are not taxed during accumulation and have tax-advantaged methods of distribution. So consider suggesting life insurance to your clients as a tax diversification strategy and help protect them against the risk of future tax increases.

Below you’ll find resources to help you describe the tax advantages of annuities and life insurance to your clients. Review and call me to discuss how we can help you implement these strategies into your practice!

.png)

:Insights That Shape the Future Tax Rate Outlook

-

At current tax rates and expenditure levels, tax revenues are projected to be fully consumed by 2030

-

The federal government had $74.3 trillion in debts, liabilities, and unfunded obligations at the close of its 2014 fiscal year

-

Budget deficits are projected to nearly double by 2024 as retiring baby boomers strain the health and retirement systems.

|

To learn more please contact Eschels Financial today!

Cyndi Stern

Phone: (248) 644-1144

Email: cyndi@eschelsfinancial.net

|

|

|

To learn more please contact Eschels Financial today!

Cyndi Stern

Phone: (248) 644-1144

Email: cyndi@eschelsfinancial.net

|

The stock market can be an uncomfortable place for some clients.

The stock market can be an uncomfortable place for some clients.

Consider these three recent bull markets*:

- 1997-2000: Up 100% before declining 86%

- 2003-2008: Up 90% before declining 53%

- 2009-2014: Up 142%… where do you think the market will go from here? Now could be a great time to exercise a “correction protection” strategy for your clients by investing in the Protective Indexed Annuity II.

If you have clients nearing retirement who are concerned about another decline, ,help them exercise “correction protection” by taking their gains out of the market and investing it in the Protective Indexed Annuity II. This solution provides protected growth, opportunities for higher returns, and even offers secure retirement income with SecurePay SE, an optional withdrawal benefit.

Contact me now for more information:

Cyndi Stern – Marketing Director

Eschels Financial Group

(248) 644-1144, ext. 110

cyndi@eschelsfinancial.net

Is your client’s non-qualified annuity or qualified annuity where it needs to be?

According to Gallup’s 2009 survey of non-qualified annuity owners:

- 81 percent surveyed intend to use their annuity as a financial resource to avoid being a financial burden on children.

- 73 percent surveyed intent to use their annuity as an emergency fund in the case of a catastrophic illness or for nursing home care.

Make sure your clients’ annuities are aligned with their intentions.

The Pension Protection Act (PPA)allows for income tax-free withdrawals from specially designed non-qualified annuities to fund long-term care expenses, regardless of cost basis. By exchanging a current annuity for an annuity that qualifies for the PPA advantages, your clients can be matched with a vehicle that can meet their needs while providing a tax advantage. Of course, before any annuity exchange is made, all factors should be weighed to verify the client’s best interest.

|

|

|

|

|

|

|

|

|

|